Start by looking at your previous three or four weeks. Your first order of business is to project your sales volume. You might want to talk to yourĪttorney or CPA about transferring your credit card deposits to another bank to regain control over these receipts. With the bank where your credit card deposits go, they may be able to sweep or divert theĬredit card receipts to pay down the loan balance. Noted, this is not typically a timing issue however, if you have bank loans or lines of credit Like most restaurant businesses, your credit card receipts may be 80-90% of cash flow. THEY ARE LIKELY EXPERIENCING THEIR OWN FINANCIAL CHALLENGES IN THIS CRISIS. LANDLORD, AND SUPPLIERS ARE NOT INSENSITIVE TO YOUR PLIGHT. Hitting your bank account is immediately reflected in your books. If might be possible to get it linked to your bank account so that every transaction

#Restaurant cashflow software

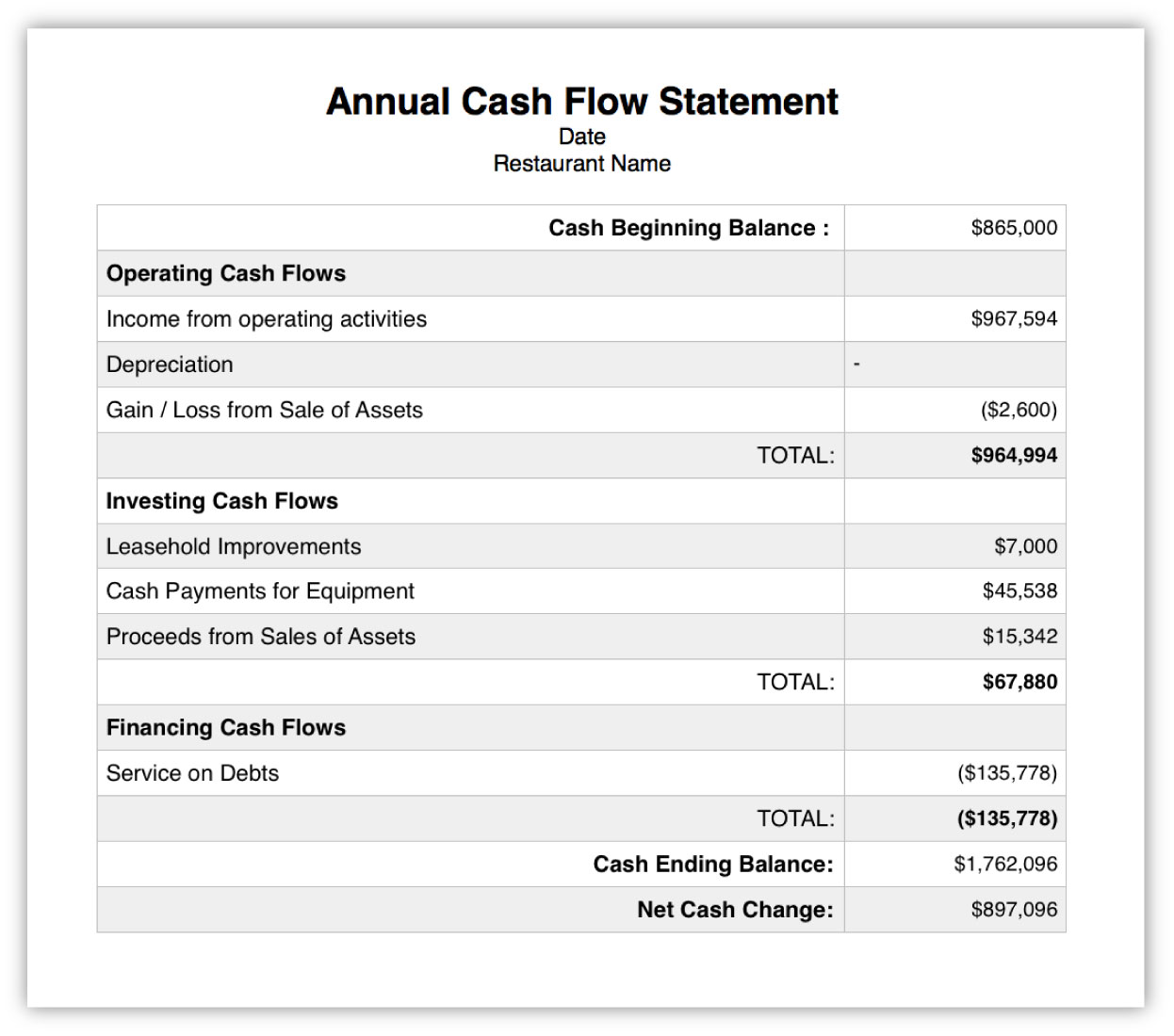

If you use QuickBooks or other accounting software package, This is challenging since you need to determine what checks haveĬleared in your accounts. You need to assess your cash balance every single day to make You might need an additional infusion of cash - perhaps a short-term loan - to supplement sales. It will help you decide where to cut costs and expenses and when The value of creating this spreadsheet is to help you project your cash inflows and outflows for You might note the spreadsheet is formatted like a typical restaurant profit-and-loss statement (P&L) with four critical categories of information: This a crystal ball, but a well-reasoned and conservative guess what to expect for the coming 12

As we will discuss, you should not consider The bases for your assumptions are likely to change. Meaning each week you will extend the horizon out another week. We will refer to it throughout this article.Īs you can see, it is a 12-week projection, and should be viewed as a moving target, Please review the model cash flow spreadsheet (above). Heavier reliance on delivery and takeout sales, and occupancy limitations during reopening, The large national chains - has a revolving credit line or ready investors.įor most independent operators, if they are fortunate, CARES Act funds are a source ofĮmergency cash as they adjust their business models to the so-called "new normal", including It is unlikely your independent restaurant business - unlike The large national chains are doing everything to obtain and conserveĬash. Sales cut off abruptly, leaving nearly every restaurant business gasping for air.įew restaurant businesses, other than quick-service concepts set up for drive through service,Īre spared from this crisis. This problem is amplified in the pandemic, with restaurant That is, our sales are often seasonal, while certain expenses, That said, many restaurants have a disadvantage in cash-flow management compared to We drive sales and keep a watchful eye on expenses.

Profit-and-loss statement (P&L) management. So, during periods of steady business, restaurant cash flow management is essentially With credit cards, we do not have to wait long for sales to show up in our accounts. And even though most of our customers pay us The restaurant business is a cash business.

0 kommentar(er)

0 kommentar(er)